Rolling in Extra Money, Return the Change

Let’s say you’re running a cash register at the movie theater (remember when we would go to movies?), and someone gives you $20 for two tickets when the total price is only $16. Do you keep the extra $4 for theater costs or improvements, or do you return the change? Each year, the state sets a budget (or ticket price) for the priorities it sees the state should address (education, healthcare assistance, roads, police, etc.). The state collects the taxes and works on the priorities. If the state takes in more tax money than it requires, the change should be returned. “Keeping the change” is simply theft.

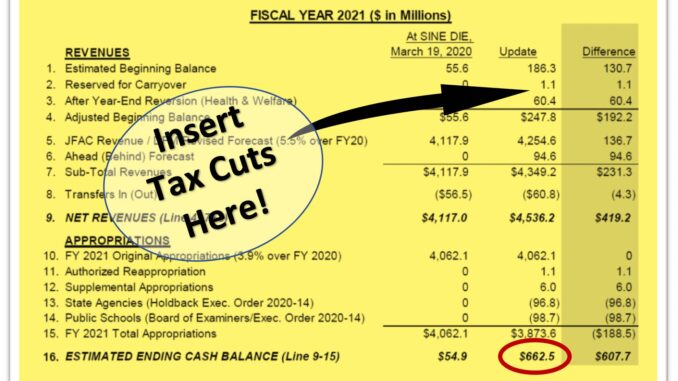

State tax collections for 2020-21 continue to come in at unexpected high levels (see the latest budget update table above)–this is excluding the direct federal CARES Act money to the state account. A lot of other CARES Act stimulus money is coming into the state budget indirectly through tax collections. But, separate from direct CARES Act infusions, the state budget (also known as the General Fund) collections for the month of January were $415.0 million, which was $58.5 million more than anticipated by the Division of Financial Management’s revenue forecast.

For the first two months of the revised forecast, General Fund tax collections have exceeded the forecast by a total of $94.6 million (line 6 in the table above). Together, with extra money coming in for 6 months prior, the state is left with an estimated ending balance of $662.5 million (circled). That $662.5 million is money in the budget of about $608 million MORE than expected. (For perspective, the entire state General Fund budget for the year was just about $4 billion, so this much extra is a huge amount.)

Our Joint Finance and Appropriations Committee (JFAC, where I participate as a member) has approved a few supplemental (unexpected) spending items and a cash transfer, with a few more unexpected spending items to come. But, overall, the state has about $600 million more in it’s bank account than it anticipated last March (when the legislature adjourned).

Rarely does a state have the opportunity for serious tax relief. This year and next is exactly such an opportunity. The state is taking in huge amounts of money and as a matter of morals, it should “return our change.” We should and must, remove sales taxes on groceries, reduce property taxes, and reduce income taxes. We can do all of them! The grocery tax repeal would amount to $128 million of the $662 million surplus. Property and Income taxes could be reduced dramatically too.

Also note that there are already plans from the Governor to increase spending on infrastructure projects around the state (the Build Idaho First proposal includes work on roads, bridges, water, etc.) to the tune of $330 million. These plans are not affected by tax relief proposals. There is so much relief and stimulus money flowing into Idaho, we should be able to meet all our obligations, especially those to the taxpayers who desperately need relief.

Please contact your representatives and senators to tell them it’s not ok for them to “keep the change.” More taxes are coming in, and they need to give back the money our hardworking families and businesses earned during a particularly difficult year. Our freedoms were infringed, and it would add insult to injury to empty our wallets too.

For additional detail regarding General Fund revenue performance versus the current forecast, please see DFM’s website. You can find your legislators’ contact information here.

The views, opinions, or positions expressed by the authors and those providing comments are theirs alone, and do not necessarily reflect the views, opinions, positions of Redoubt News. Social Media, including Facebook, has greatly diminished distribution of our content to our readers’ newsfeeds and is instead promoting Main Stream Media sources. This is called ‘Shadow-banning’. Please take a moment and consider sharing this article with your friends and family. Thank you. Please support our coverage of your rights. Donate here: paypal.me/RedoubtNews